Your Small Business Financing Solution

Unlike traditional small business loans, eligible Novo customers can apply for fast, flexible working capital online in minutes with Novo Funding. Apply for Novo’s checking account to get started.

Novo Funding offers:

- Working capital for your small businesses in the form of a Merchant Cash Advance

- 24-hour decisioning

- Instant access to funds

- No limitations on the use of funds

- Straightforward repayment

- Fees only on the funds you use

.avif)

Banking that works for you and your business

Easily get up and running with Novo, so you can spend less time banking and more time growing your business. No more monthly fees, minimums, or waiting in line for a teller.

Get Started

Enjoy peace of mind

Rest assured you’re covered with Mastercard’s Zero Liability and ID Theft Protection programs. Plus, get automatic fraud and purchase alerts.

Ditch the distractions

Unlike credit cards, Novo’s debit card is free, and you don’t have to worry about confusing rewards programs.

Take back time

Novo automatically categorizes your spending so you can save time (and money) on bookkeeping and taxes.

Freedom from fees

Say goodbye to hidden fees, monthly fees, and required minimum balances.

Fast money movement

Manage your cash flow with Novo’s flexible payment and deposit options to save time and cost.

Your financial hub

Enjoy automated budgeting, working capital, and integrations with the tools you’re already using, like Stripe, Amazon, and QuickBooks.

Deposit & send checks

Manage your money with ease by depositing and sending checks right in the Novo app.

Smart insights

Enjoy automatic categorization and an overview of your business’s finances, all in one place.

Virtual debit card

Start spending with your virtual debit card as soon as you make your first deposit into your Novo account.

Unlimited transactions

With no transaction limits, you can spend how and when you want, using your Novo debit card.

Fast & easy transfers

Pay by free ACH transfers, or use Express ACH for the speed of a wire transfer at a fraction of the cost.

Expert customer support

Have a question or a concern about your account? Our dedicated Novo team is always here to help.

Solutions

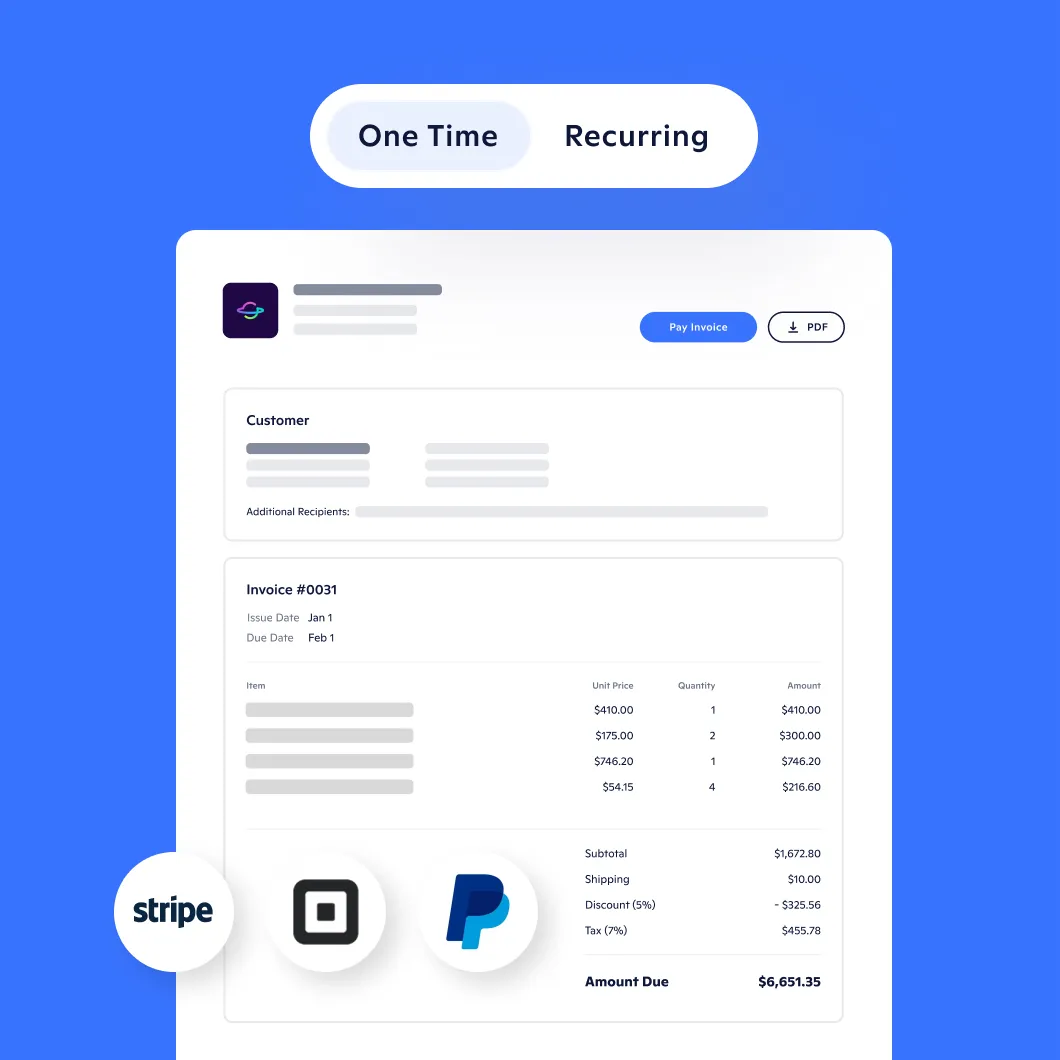

Invoices

Free and flexible invoices

Create and send an unlimited number of fully customizable invoices from directly within your Novo account.

Integrations

Integrate with the services you already use

From Stripe to Shopify, Novo connects with over a dozen apps so you can take action and get insights from your Novo account.

Partner Perks

Enjoy exclusive partner perks

Save thousands on popular tools including Quickbooks, Gusto, and Hubspot with perks exclusive to Novo customers.

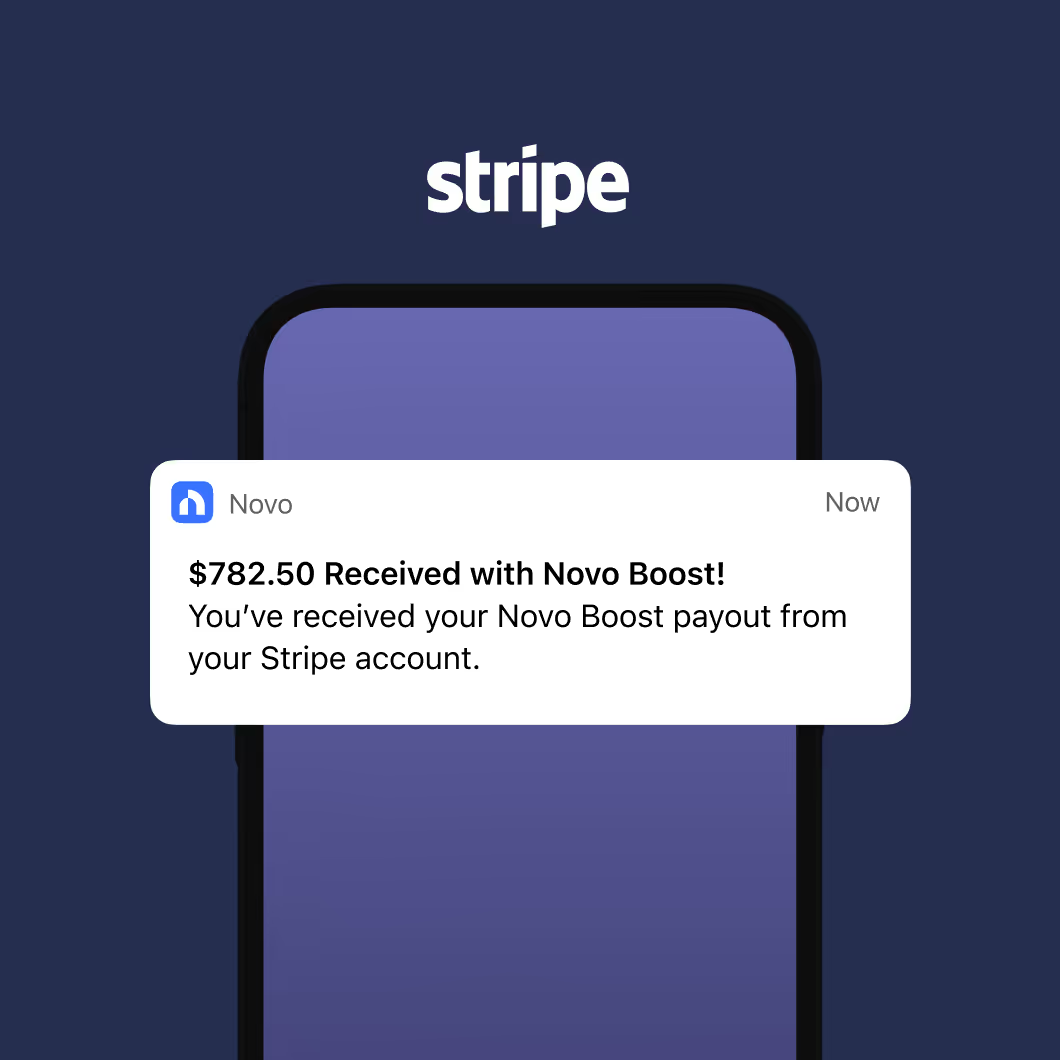

Novo Boost™

Give your cash flow a boost

With Novo Boost, get your Stripe payments 95% faster, free of charge. The faster you access your revenue, the faster you can reinvest in growth.

Don't just take our word for it

When I switched to Novo, I saved $36 a month on fees. I put that money towards a Slack subscription - which has been a lifesaver!

I love that you can connect to Shopify and Stripe and all the tools I use for my business. And I love that there are so many ways to get paid.

I like how accessible Novo is. I can do everything in one place. My account is connected to Square and it’s really cool to see everything right there.