f you’re a small business owner, chances are you’ve come across the terms “balance sheet” and “income statement” more than once.

While balance sheets and income statements are both financial records that give you insight into how your business is performing, they are very different in terms of scope.

We’ll clarify the differences between the two and cover why and when you need to utilize the pair together.

What is a Balance Sheet?

The quick definition: A balance sheet provides a snapshot of your company’s financial condition on a particular date. It is a summary of what your business owns (assets) and owes (liabilities).

What’s on a balance sheet?

The main components of a balance sheet include:

Assets

Anything your company owns, typically split into these categories:

Current assets: Think of these assets as cash or anything that can be sold for cash within one year. Examples of current assets include:

- Cash

- Inventory

- Accounts receivable (Outstanding payments owed to you)

Fixed assets: Think of these as assets that can’t typically be sold within one year. Some companies also have intangible assets, like trademarks and patents. These would be considered fixed assets. Examples of fixed assets include:

- Equipment

- Land

- Long-term loans

- Buildings

Liabilities

Anything your company owes, typically split into these categories:

Current liabilities: These are expenses that your business will owe within a one-year period. Examples include:

- Accounts payable

- Deferred taxes

- Credit card balances

Long-term or noncurrent liabilities: These liabilities are typically long-term expenses owed, like:

- Business loans

- Mortgages

- Leases

- Bonds

Equity

Also known as owner’s equity, this includes anything remaining after you subtract all liabilities from the company’s assets.

How does a balance sheet work?

This is the basic equation for any balance sheet:

Assets = Liabilities + Equity

In other words, your company’s assets should equal the total amount of its liabilities and equity.

When should I create a balance sheet?

Most companies produce balance sheets on a regular basis (monthly, quarterly, or annually), but they can be produced any time you want an overview of your business’s financial standing.

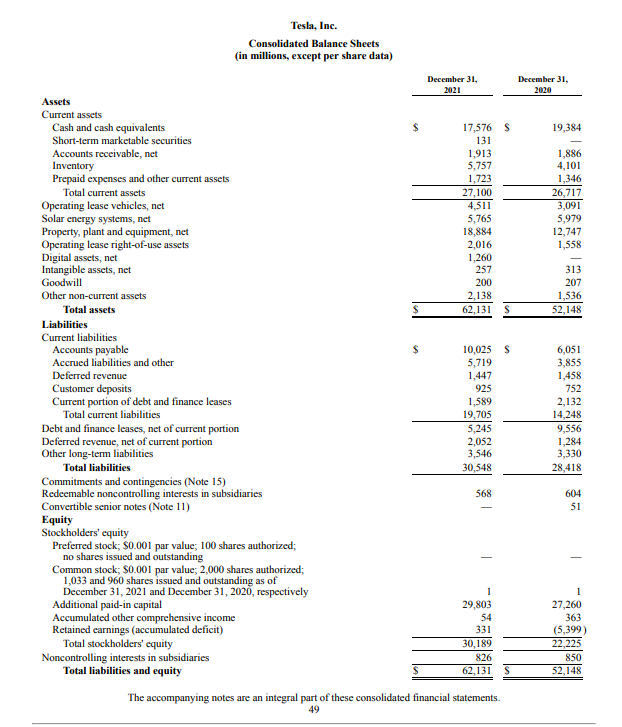

Example of a balance sheet

This example balance sheet is from Tesla, Inc. and was included in its 10-K filing. One interesting aspect of Tesla’s business is its $1 billion+ investment in Bitcoin, which is recorded on its balance sheet as a Digital Asset.

What is an Income Statement?

The quick definition: An income statement shows revenue, expenses, and net income for a given period of time to assess a company’s long-term path. It doesn’t mention cash flow, meaning cash or non-cash sales.

What’s on an income statement?

The main components of an income statement, also known as a profit and loss (P&L) statement, include:

Revenue

The total amount of money generated by the business operations within the time frame in question.

Expenses

- The total amount of money spent to operate the business within the specific time frame.

- This includes the cost of goods sold (COGS) and/or the cost to produce services offered.

- Operating expenses include selling and administrative expenses, advertising, and lease payments. Depreciation and amortization also are included in the income statement.

Net income or loss

Commonly referred to as the bottom line, this refers to earnings after expenses, interest, and taxes.

How does an income statement work?

An income statement differs from a balance sheet in that it provides a detailed breakdown of all revenue and expenses.

When should I create an income statement?

Income statements are calculated for a period of time. They are generally produced monthly, quarterly, and/or annually.

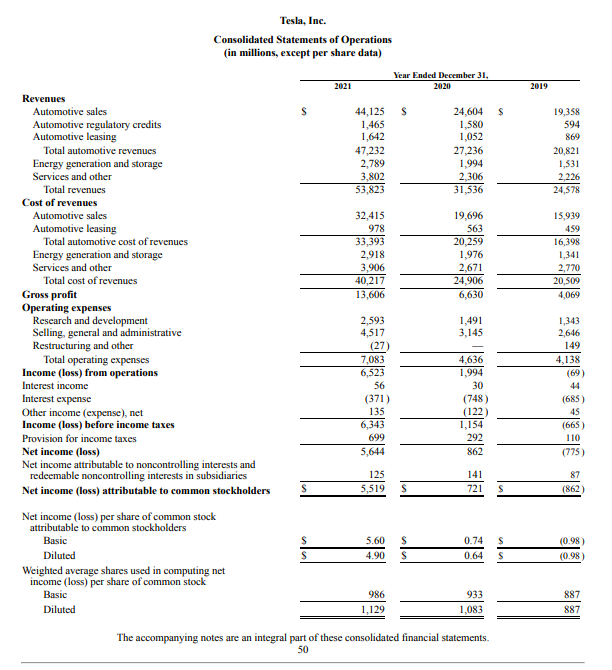

Example of an income statement

Sticking with Tesla Inc., below are the company's income statements from 2019, 2020, and 2021, showing a net loss followed by a profit. It is common to see data presented for three consecutive years to allow for comparison.

Differences between a Balance Sheet and an Income Statement

A balance sheet and an income statement are different in the main components they measure, the time frames they cover, the analysis they offer, and how they are used.

Here’s a quick overview of the main differences:

What’s the purpose of using both documents?

This guide is not about choosing one of these over the other for your business — there’s no competition! Both are key components of a financial statement package, and neither can tell the full story of the business’s financial performance alone.

An income statement tells you if your business is bringing in a profit (or a loss), while balance sheets can give you a broader picture of your company’s worth.

At a high level, a balance sheet gives you a snapshot of your business’s financial position, including its value. This means you can use a balance sheet to:

- Assess whether the business has enough cash to cover its obligations

- Calculate leverage ratios, such as debt ratio and debt-to-equity ratio

At a high level, an income statement tells you exactly how much your business earned at the end of each reporting period. Since income statements give you a deeper view into your operations, you can use these to:

- Assess growth in revenue over time

- Assess change in expenses over time

- Calculate profitability ratios, such as gross profit margin, operating profit margin, and net profit margin

How the balance sheet and income statement can be used together

While balance sheets and income statements can tell you a lot about different aspects of your business individually, you need both, along with cash flow statements, to get the full picture.

When you have both a balance sheet and income statement handy, you can calculate liquidity and efficiency ratios such as:

- Average collection period

- Accounts receivable turnover

- Inventory turnover

- Fixed asset turnover

- Total asset turnover

- Return on total assets

- Return on equity

These are all important indicators of how well your business is being managed. You can compare changes in these ratios over time, or you can compare these to benchmarks for your industry.

How to organize income statements and balance sheets

Since balance sheets and income statements give you different insights into your business’s financial position, your best bet is to use them together consistently.

A good rule is to start with the income statement since you’ll need to calculate your profit (or loss) before you can determine equity.

Most companies will create both financial statements for every reporting period, so get comfortable with producing these on a regular basis. Set time aside each month or quarter to dig deep into your finances and become familiar with all components of these documents, as well as your other cash flow statements.

Takeaways

By now, you have a clearer understanding of the differences between a balance sheet and an income statement. Additionally, you should now recognize how both of these items can give you more insight into your business.

With that knowledge, you can make better, informed decisions, determine the best course of action for your company’s future, and feel confident in growing your business. You will also want to have both statements organized when you go to prepare your taxes and if you intend to apply for a business loan or a commercial lease.

Novo Platform Inc. strives to provide accurate information but cannot guarantee that this content is correct, complete, or up-to-date. This page is for informational purposes only and is not financial or legal advice nor an endorsement of any third-party products or services. All products and services are presented without warranty. Novo Platform Inc. does not provide any financial or legal advice, and you should consult your own financial, legal, or tax advisors.

%201.png)

.png)