The unsung hero of last-minute financing

Novo Funding helps you move quickly and simply

Minimal paperwork, maximum speed

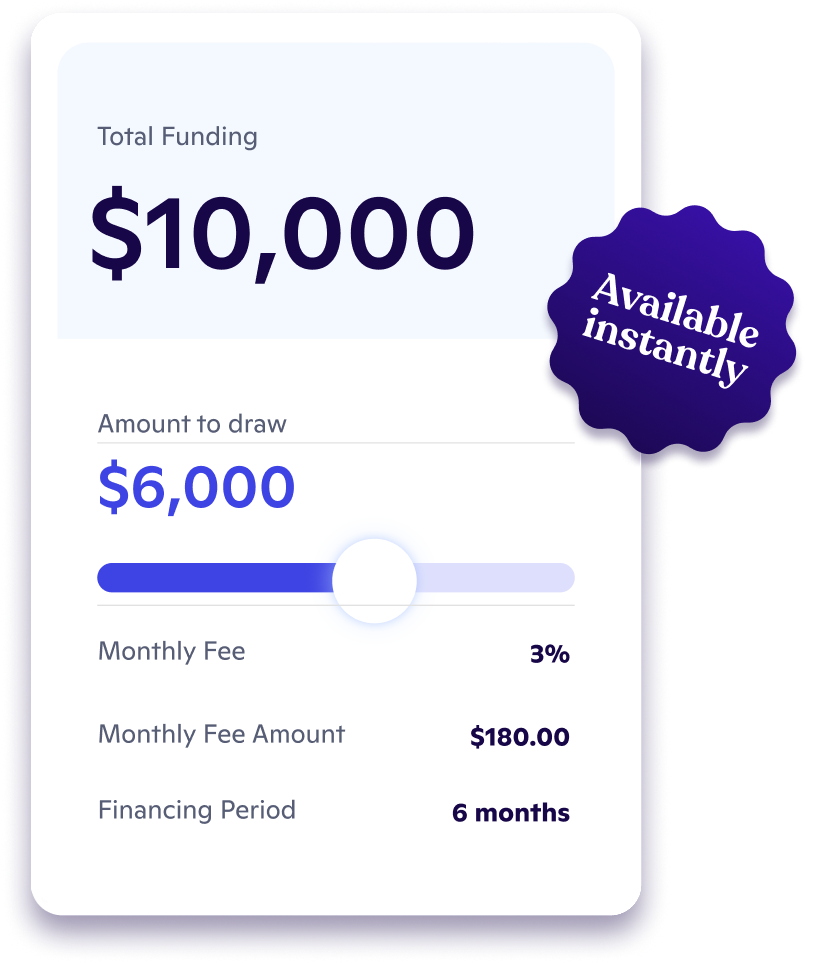

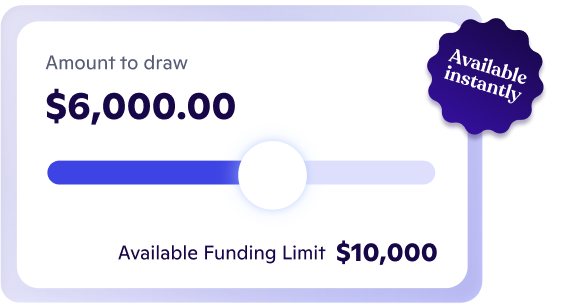

Since Novo Funding is only available to prequalified customers, the application is nearly effortless — allowing you to access cash instantly.

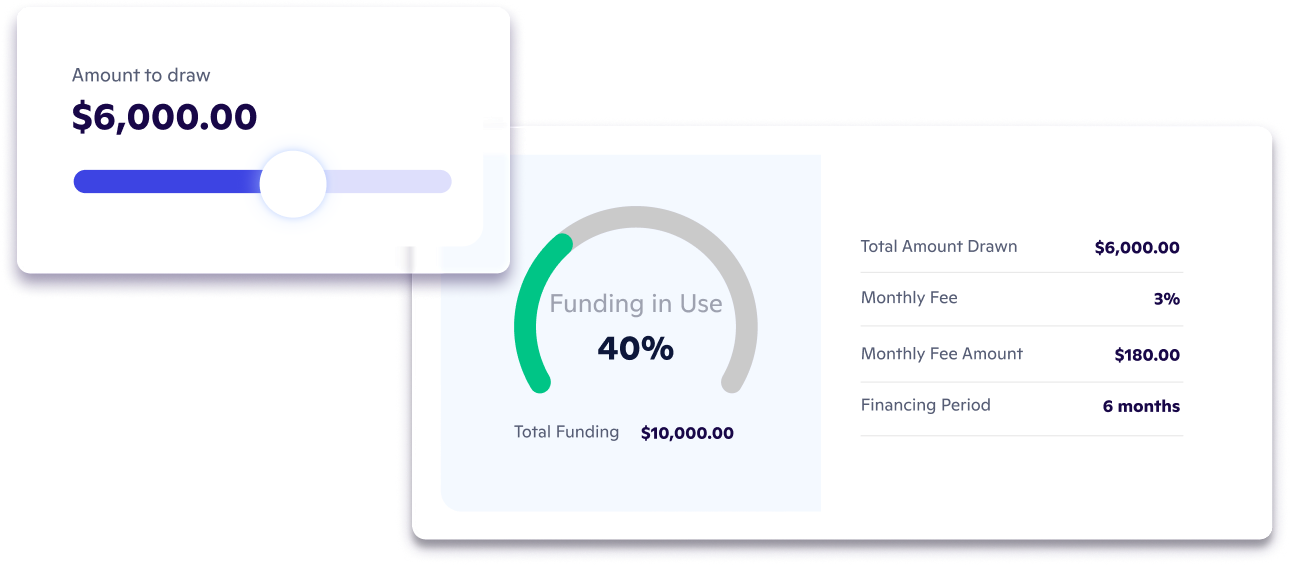

Pay only for what you use

Draw funds when you need them and pay only for what you use, keeping your cash flow under control.

Clear costs. Fast cash.

What you see is what you pay. Simple, transparent fees let you decide quickly and receive funds instantly.

Easily see what’s due and when

Each draw is designed to be settled over six months, and your dashboard shows exactly what’s due and when.

See how others are using Novo Funding

How Novo Funding compares to a traditional business loan

Novo funding

Traditional business loan

Approval speed

Near instantaneous after applying

Days to weeks

Repayment timeline

Repaid over a six month period

Highly variable

Fee transparency

Clear and upfront;

no hidden fees

Can include hidden fees and penalties

Best for

Quick, immediate cash on hand

Planned long-term growth