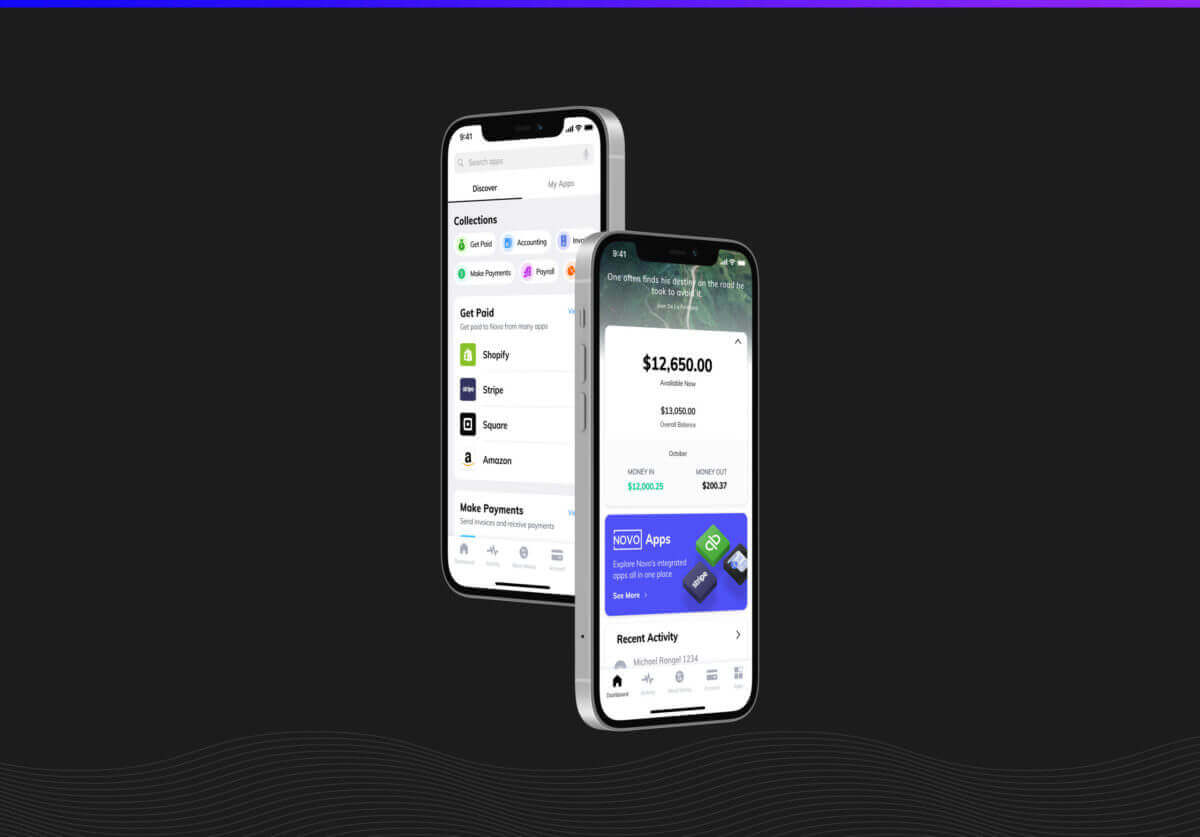

Novo Launches App Marketplace to Help Small Businesses Unify their Checking and Finances

Small business users can quickly and easily create a customized platform that integrates all their finance-related applications, saving them time and money.

MIAMI, October 28, 2021 — Novo, the powerfully simple small business banking platform, today launched the Novo App Marketplace to help small businesses seamlessly tailor their banking platform and increase visibility into their business finances and cashflow. Novo is a fintech, not a bank. Banking services provided by Middlesex Federal Savings, F.A.; Member FDIC.

“Small business banking has a square peg, round hole problem — online banking products don’t work well with the financial applications business owners prefer using, and leave it to them to cobble together a picture of their finances and cash flow through multiple applications,” said Michael Rangel, co-founder and CEO of Novo. “At Novo, we're embracing the uniqueness of small businesses across the country and empowering them to customize their banking experience as they see fit. Small businesses who choose Novo will see that the open ecosystem approach we’re introducing gets rid of the square peg, round hole problem.”

With the Novo App Marketplace, small businesses can set up their banking platform to give them instant visibility into everything from e-commerce sales, to pending invoices, and cash-on-hand. The Novo App Marketplace also allows small businesses to take advantage of dozens of integrations, and manage connections with hundreds of platforms. Instead of having to jump between several applications for small business financial tasks such as sending out invoices or creating reserve accounts for accounting, users will be able to conduct many of their banking workflows directly through the Novo platform, saving them time and resources.

“Today, one of the biggest financial pain points for small businesses is piecing together their cash flow through myriad online portals — their checking account, the multiple sites they sell their products on, their payroll service, their invoicing application, and more,” said Chris Danison, product manager at Novo. “With the Novo App Marketplace, small business owners can finally get a complete picture of their finances and cashflow, all in one place. As the Novo App Marketplace expands, so will small businesses’ ability to tailor and optimize what their digital banking solutions can do for them.”

Novo is introducing the Novo App Marketplace during a time of significant growth for the company. Novo has surpassed $4 billion in lifetime transactions — processing more than $3 billion in transactions in 2021 alone. Novo also opened its new headquarters in Miami, announced $40.7 million in Series A funding, and received multiple awards, including CNBC’s “Best Business Checking Accounts of October 2021,” Money Magazine’s “Best Business Checking Accounts of 2021,” and the Banking Innovation award from The Banker at its 2021 Digital Banking Awards.

The Novo App Marketplace is free to use and immediately available to Novo’s more than 100,000 small business customers, as well as all new customers.

About Novo Novo is the powerfully simple banking platform for small businesses. To learn more, visit www.novo.co.