he world of technology is changing faster than ever, and the rise of women in tech is part of why we're moving in a positive direction. We've witnessed this positive transformation in the fintech space, where women are propelling innovation by developing new strategies, systems, and tools of transformation. Through these women-led businesses, we are all becoming more enlightened as entrepreneurs and human beings. It has been a challenge for women to break into the tech space for decades. Small Business Trends points out that women only hold 20% of all tech jobs in the U.S. This a damning statistic when considering more than half the U.S. workforce are women. The Women in Fintech 2016 list shows that the underrepresentation of women in the workforce is even more apparent in financial technology as women founded 21 of the 260 companies on the list. However, the tide is changing as research shows that organizations founded by women, or the ones that support women in fintech drive innovation and improve financial results. Today we are highlighting five women in tech who are leading the charge with new business ideas, groundbreaking technologies, and strong leadership skills. This list is in no particular order.

Laura Spiekerman - Co-Founder and CRO of Alloy

Laura Spiekerman created Alloy to help financial services businesses become better at vetting customers. The API looks at advanced ways to determine what makes a "good" customer because these organizations often have a hard time identifying who this could be. This oversight causes companies to lose out on potentially significant customers. Alloy puts a variety of data sources into a rules engine to reduce the chances of fraud. This technology also helps financial services organizations bolster relationships with banks and regulators so they can adhere to compliance standards more effectively. We reached out to Laura, and she shared the inspiration behind Alloy with us:

We started Alloy because we believe that by providing infrastructure to the next generation of digital financial services, people will have access to better products and services in their financial lives. We we were inspired by all the innovative new applications and services we were seeing, and we think we're just at the beginning.

Laura now has nearly a decade making waves in the fintech space. She's had leadership roles with payments app Knox Payments and investment firm Kopo Kopo.

Sallie Krawcheck, Co-Founder and CEO of Ellevest

Source: Ellevate

Ellevest is one of the most crucial fintech startups in the world right now because it aims to narrow the gender investing gap. CEO and Co-Founder Sallie Krawcheck is the leader behind it all, empowering women by providing them with customized investment portfolios through her company. Sallie built the company when it became clear that the investing biz was "by men, for men," so she created Ellevest to create a new model for women. Ellevest’s website says the company exists as “women typically live longer than men, yet we’re paid less”. The company uses data factors in gender differences such as the pay gap, career breaks, and lifespan. These customized portfolios ask investors how much they’re looking to save by retirement, risk tolerance, and more. Diversification is the name of the game for Ellevest, reducing risk and protecting against unforeseen circumstances. Sallie’s company uses a computer-based analysis that simulates hundreds of different economic outcomes to create the best portfolio for each investor. The goal is to give women the tools they need to achieve their financial goals.

Ellevest's Instagram page is another window into Sallie's philosophy on how to succeed as an investor. She has previously worked as CEO of Merrill Lynch.

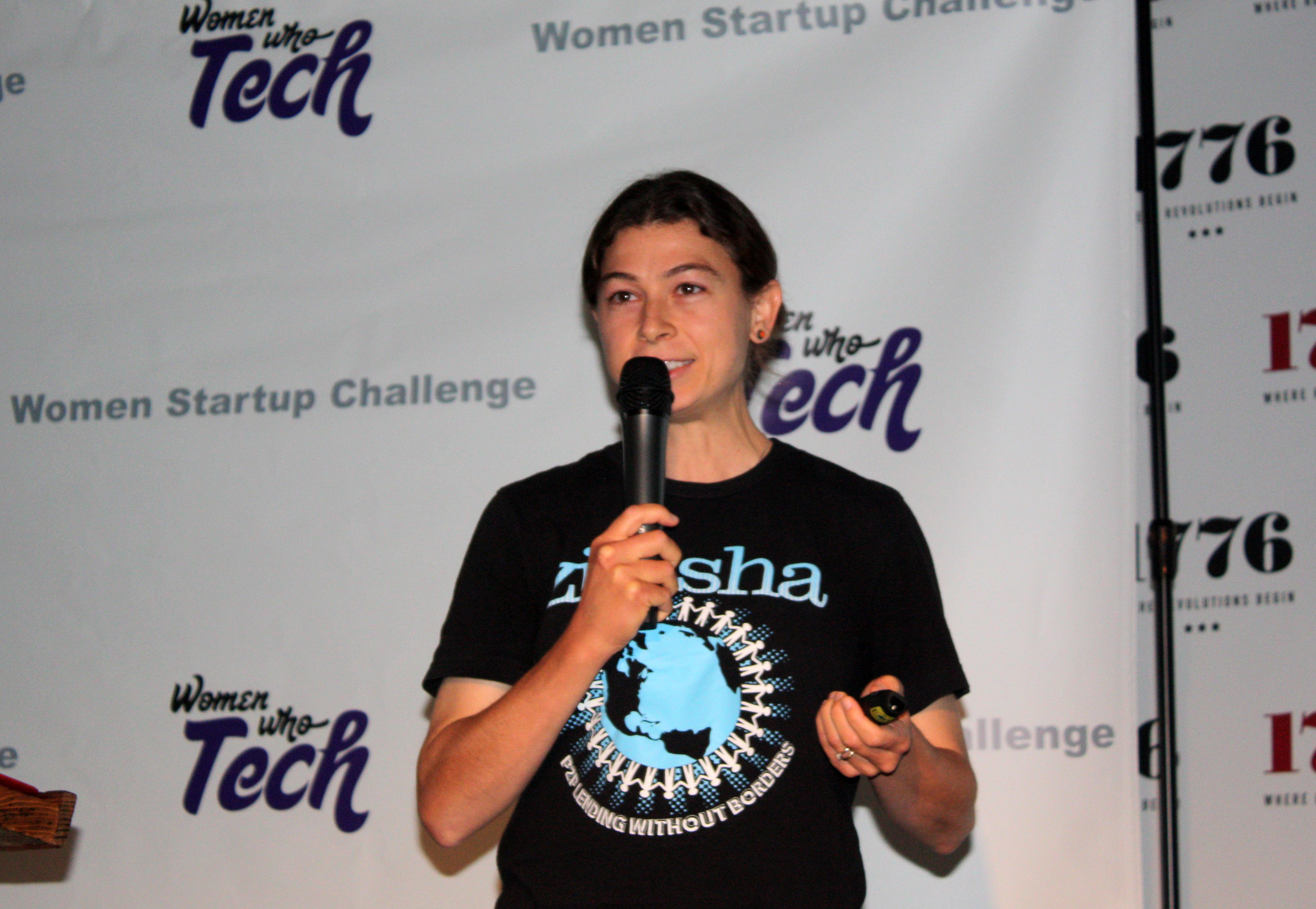

Julia Kurnia - Founder and CEO at Zidisha

Source: Flickr

Zidisha is another fintech startup opening doors for the underrepresented. The business wants to make entrepreneurs' dreams come true with an online marketplace that paves the way for small business loans. Founder and CEO Julia Kurnia created the “direct microlending" platform to help out budding business owners in developing countries. The story of Zidisha begins in 2008, when Julia spent Thanksgiving Day in the famine-stricken African nation of Niger. The female founder was managing overseas grants and refused to stay in the same hotel as her colleagues. "The hotel cost more per day than many Nigerians earned in a year, and I couldn't stand the disparity," she said. Julia further saw this disparity in children who were begging her for food, fighting for their survival. Her experience in international finance and this new outlook opened the door for Zidisha. The company is changing lives as it reduces the cost of microloans from the global average of 40% to under 10%. The Zidisha team works every day to bridge the international wealth divide, and Julia is the driving force carrying this movement forward. We may one day live in a world where "developing countries" will be a term of the past, thanks in part to Julia and Zidisha. Julia previously worked as a portfolio analyst for the U.S. African Development Foundation.

Teresa Y Hodge - Founder and CEO of R3 Score Technologies

Source: Twitter

Female founder Teresa Y Hodge launched R3 Score Technologies to help reintegrate marginalized individuals back to society. The mobile platform allows those with a criminal history to find banking options that suit their needs, work, and education in line with their talents. Teresa spent 70 months in federal prison for a non-violent, first-time offense. This experience provided her with first-hand experience of the U.S. criminal justice system, leading to R3 Score. The company's technology helps out similar individuals to Teresa, looking at factors other than their record to better measure their financial capacity. One in three adult Americans have a criminal record, and these individuals often have a difficult time finding ways to reintegrate society. Teresa and R3 Score are pushing back against these regulations, giving a voice to these disenfranchised individuals. Teresa is also the Co-Founder and Director of Innovation & Strategy of Mission: Launch, offering entrepreneurial training, coding, and more to individuals with a criminal record.

Diana Biggs - Global Head of Innovation of HSBC Private Banking

Source: Diana Biggs

Diana Biggs is helping to develop digital innovation initiatives at HSBC in a way that’s unheard of until now. She is paving the way for entrepreneurs to create new business models, connect the fintech world with strategic partnerships, and implement emerging technologies to the industry. Diana’s efforts are building "an inclusive culture of innovation" at HSBC. She believes in using these technologies to empower women in leadership roles and other disenfranchised groups, leading her to assume more impactful leadership positions. She is a board member of the Digital Leaders Europe with the World Economic Forum, fostering collaboration across industry founders, investors, and regulators in Europe to promote "gender diversity," digital upskilling, and "entrepreneurial talent mobility. Diana's global efforts span more than 15 years across five continents. These include propelling operational improvements and creating partnerships for microfinance institutions in Burkina Faso and Sierra Leone with her previous e-commerce platform Soko. In this role, Diana worked to find economic opportunities for small-scale artisans in East Africa, opening the door for women in this region to share their talent with the world for a profit. She has continued these efforts as a Committee Member for Her Stories, a London-based annual event that helps charities for vulnerable women in the U.K., while also celebrating women artists. Diana is also Head Tutor for the Oxford Said Business School Blockchain Strategy Programme, educating entrepreneurs on how the technology can affect their organizations.