Novo vs Bluevine: Simple banking. No tiers. No guesswork.

See how Novo and Bluevine compare across interest and rewards, integrations, invoicing, and funding, so you can choose the right fit for your business.

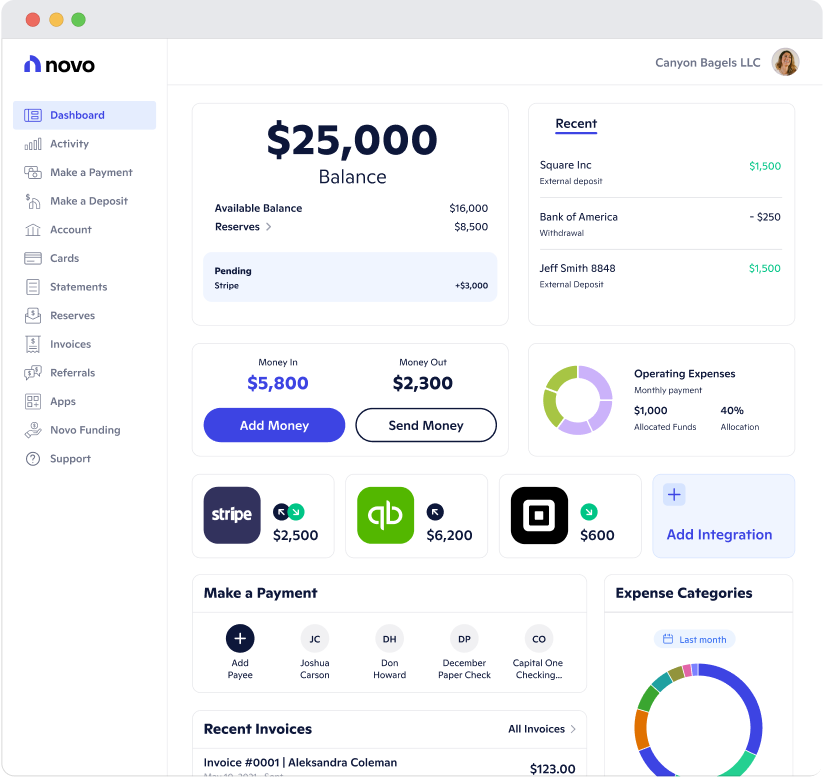

Why 250,000+ businesses rely on Novo

With Novo, you get the best of both worlds: the convenience of a modern banking platform and the confidence of knowing your money is backed by Middlesex Federal Savings, a bank that’s been trusted for more than 130 years.

Novo delivers the tools you rely on, the flexibility to keep your business moving, and the dependable experience you expect from a platform built for growth.

Here are just some of the features our customers love:

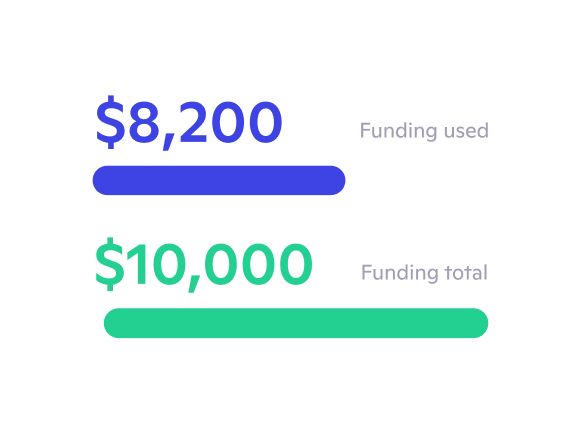

For eligible customers, Novo offers:

How Novo Compares to Bluevine

Bluevine

Monthly Fee

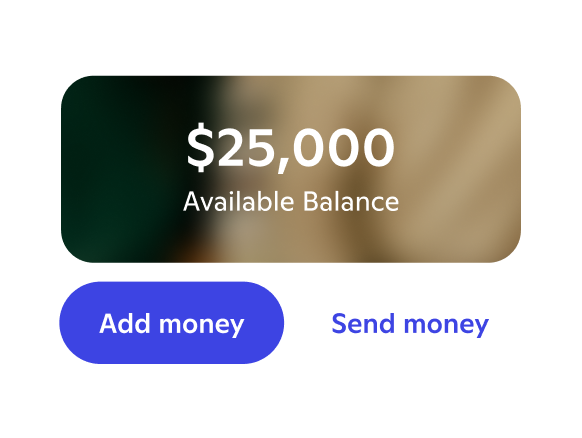

$0

Integrations (Stripe, QuickBooks, Xero, Gusto, Squarespace, etc.)

⚠ QuickBooks; limited

ecommerce integrations

Built-In Invoicing

Automated Budget Allocation

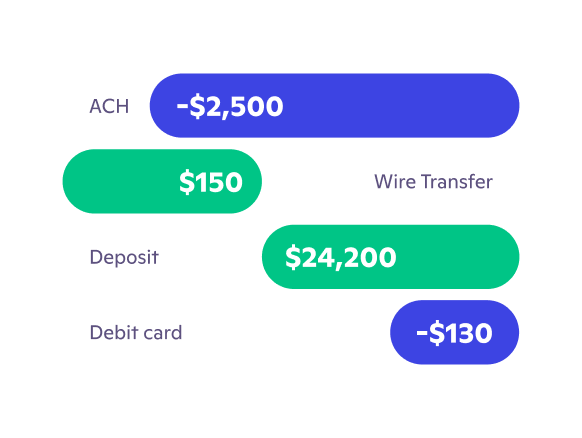

Faster Payments (Express ACH/ Same-day ACH)

Express ACH + options

Same-day ACH available

AI-Powered Bookkeeping

⚠ No AI categorization; supports transaction syncing via accounting integrations

2% Cashback Business Credit Card

ATM Access & Fees

$7/month ATM fee reimbursement

⚠ Fee-free in-network; fees out-of-network

High-Yield APY

Up to 3% on qualifying balances*

Hear directly from the businesses who bank with us

Frequently Asked Questions

Does Novo offer a business credit card?

Bluevine offers APY. Why doesn’t Novo?

Which is better for fast payments?

Which platform integrates better with Stripe and Shopify?

Does Novo offer lending like Bluevine?