Novo vs Lili: Business banking without paid feature tiers

See how Novo and Lili stack up, from invoicing and tax tools to cashback rewards and integrations, so you can choose the right fit for your business.

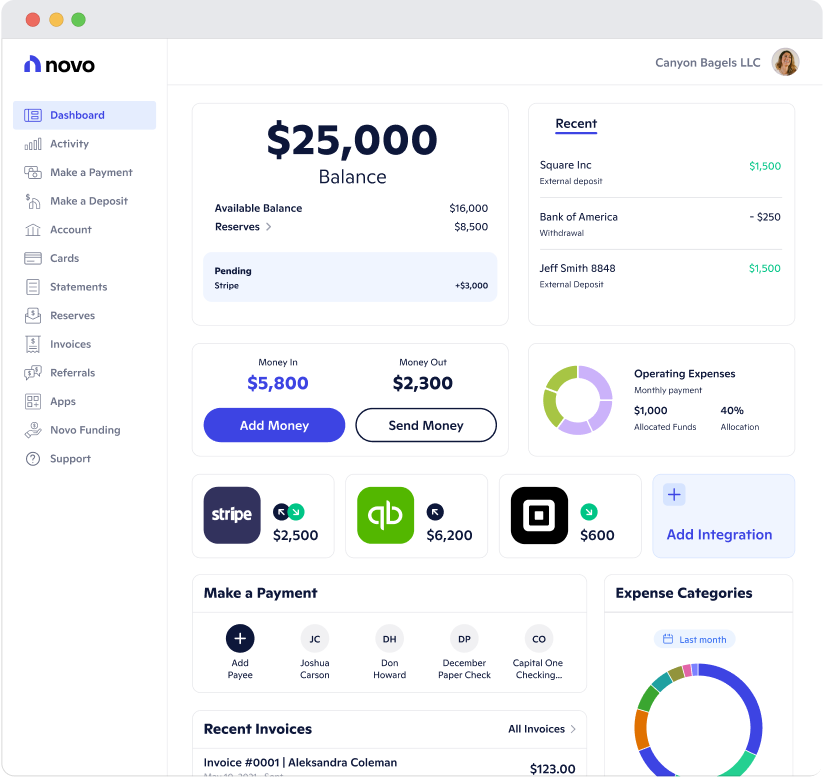

Why 250,000+ businesses rely on Novo

With Novo, you get the best of both worlds: the convenience of a modern banking platform and the confidence of knowing your money is backed by Middlesex Federal Savings, a bank that’s been trusted for more than 130 years.

Novo delivers the tools you rely on, the flexibility to keep your business moving, and the dependable experience you expect from a platform built for growth.

Here are just some of the features our customers love:

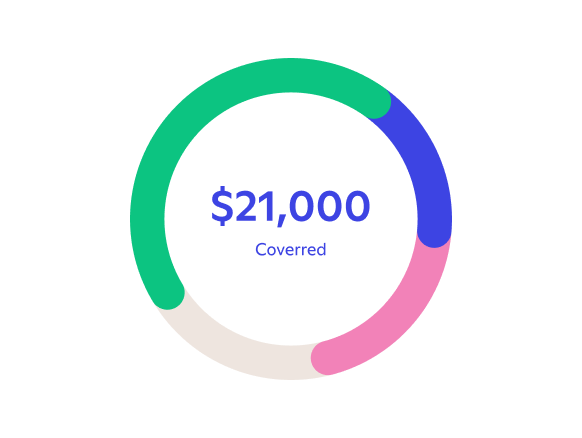

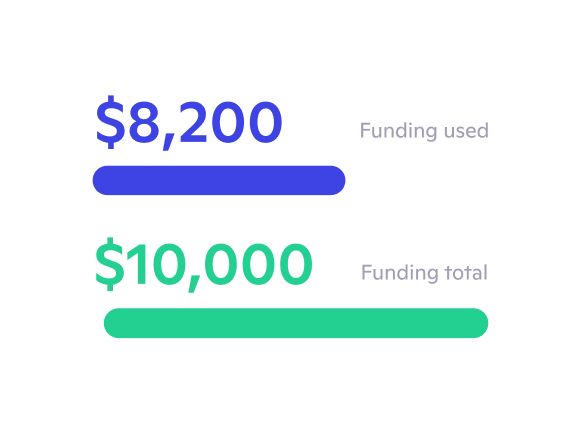

For eligible customers, Novo offers:

How Novo Compares to Lili

Lili

Monthly Fee

$0

$0 core; $9–$35/month paid tiers

Integrations (Stripe, QuickBooks, Xero, Gusto, Squarespace, etc.)

Built-In Invoicing

Automated Budget Allocation

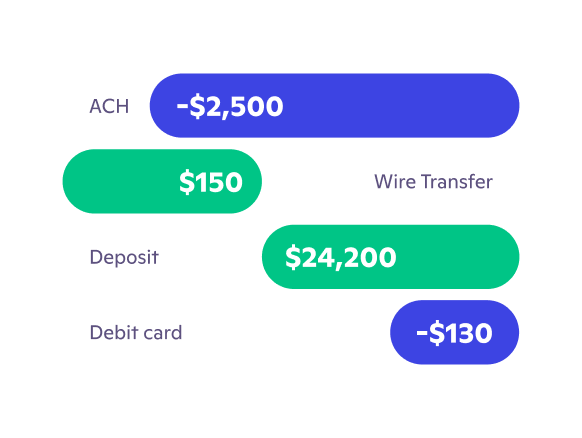

Faster Payments (Express ACH/ Same-day ACH)

AI-Powered Bookkeeping

2% Cashback Business Credit Card

High-Yield Savings

Up to 4% on qualifying balances*

Hear directly from the businesses who bank with us

Frequently Asked Questions

How do Novo and Lili differ on interest and credit features?

Does Novo include tax tools?

Do I need to upgrade for invoicing?

Which platform integrates with QuickBooks?

Are there monthly fees?