Switching from

North One?

Novo makes it easy.

With North One closing, it’s the perfect time to move to a banking platform solution that works harder for your business.

Why 250,000+ businesses rely on Novo

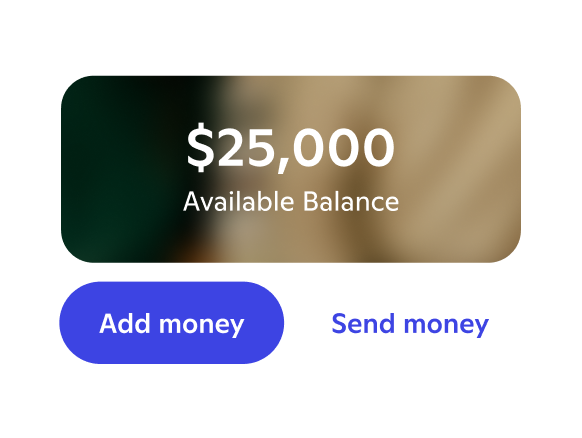

With Novo, you get the best of both worlds: the convenience of a modern banking platform and the confidence of knowing your money is backed by Middlesex Federal Savings, a bank that’s been trusted for more than 130 years.

Novo delivers the tools you rely on, the flexibility to keep your business moving, and the dependable experience you expect from a platform built for growth.

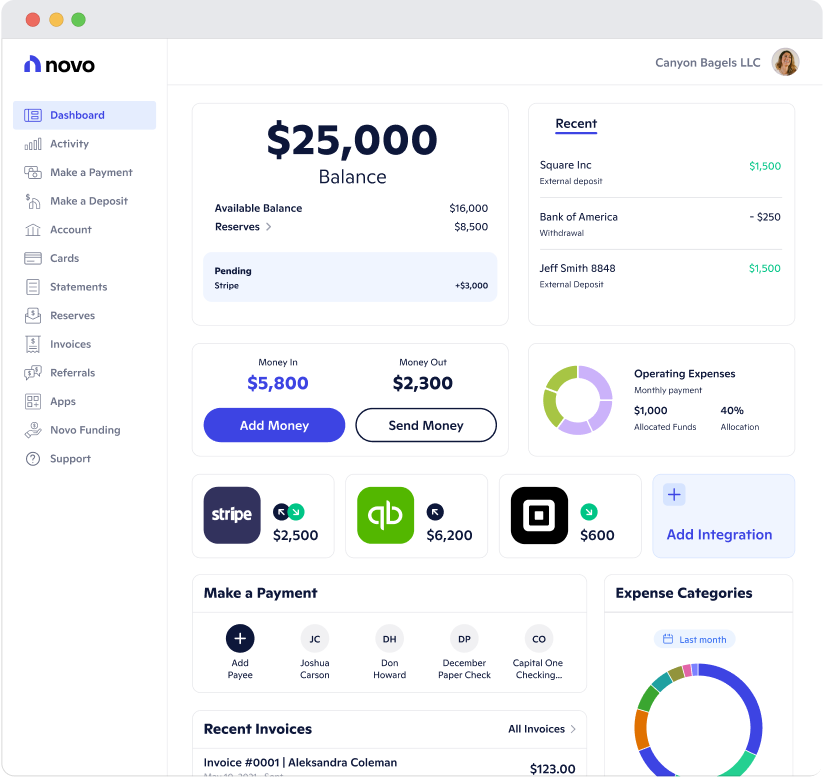

Here are just some of the features our customers love:

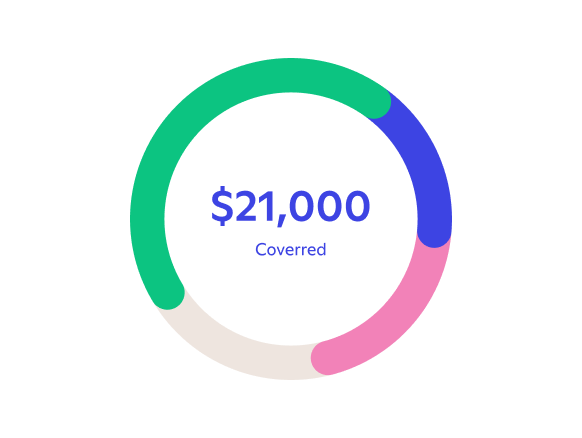

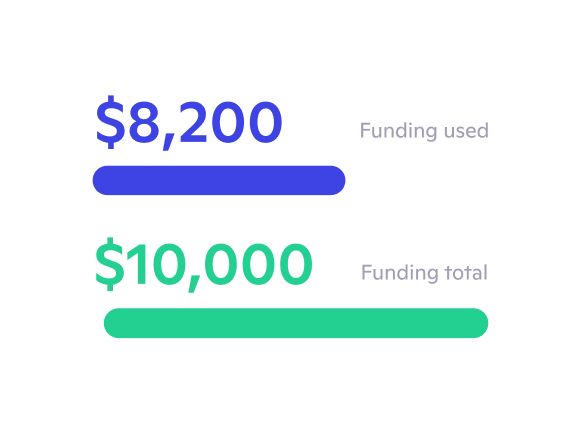

For eligible customers, Novo offers:

How Novo Compares to North One

North one

$0 maintenance fees

Free standard ACH transfers

Invoicing directly from app

Built-in budgeting tools

Debit card offered

Mobile App

Cash back credit card offered

Yes, up to 2% on eligible business purchase*

No credit card offered

App integrations

QuickBooks, Stripe, Square, Shopify, Amazon, Wise, and

more

QuickBooks, Stripe, PayPal, and more

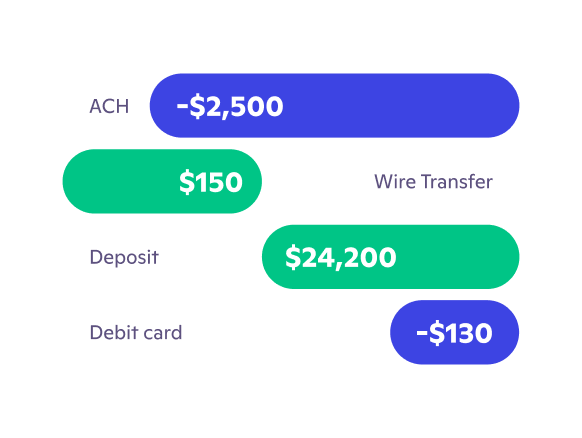

Wire Transfers

Free incoming domestic wires; outgoing wires available in beta for limited users

Free incoming wires; outgoing wires incur a S15-20 fee

Deposits

Cashier's checks and money orders can be deposited via app; Cash deposits not directly supported

Cash deposits available via partner ATM networks

ATM Access & Fees

Most ATM networks supported with up to $7 in fees/month refunded

Must use Allpoint network to avoid fees;

Some limitations apply

Hear directly from the businesses who bank with us

Frequently Asked Questions

What do I need to do to open a Novo account?

How can I get in touch with Novo customer support if I have questions?

How do I get my money out of North One and into Novo?

How do I convert my Envelope settings into Novo Reserves?

How do I keep processing payments while switching from North One to Novo?

How do I pay my invoices while I switch over to Novo?

How do I fund my payroll with Novo?

How do I migrate my invoices to Novo?