Stripe Fee Calculator

Use our Stripe fee calculator to determine how much you'll pay in Stripe transaction fees and what you should charge to receive your desired amount.

Understanding Stripe Fees

Stripe is a popular online payment processing platform designed to help companies of all sizes accept payments, manage business finances, and grow revenue. It’s ideal for businesses that accept online payments, but Stripe also offers a point-of-sale system, called Stripe Terminal, for in-person transactions. One of the main benefits of using Stripe is its straightforward fee structure, which is made up of a percentage fee and/or a fixed fee.

Our calculator uses Stripe’s online payments and digital wallets fee of 2.9% plus $0.30 per transaction. Enter your transaction amount to see what Stripe charges, what you’ll take home, and what you should charge to account for the fees.

Keep reading to learn more about other types of Stripe transaction fees, as well as how to maximize your revenue and minimize processing fees.

How much are Stripe fees?

The most common Stripe fee is 2.9% plus $0.30 per card and digital wallet transaction. There are additional fees associated with other types of Stripe transactions. For U.S.-based businesses, standard Stripe fees include:

*Information accurate as of February 23, 2023

Certain transactions may also be subject to additional fees, including:

- 1% fee for international cards and digital wallet payments

- 1% fee for currency conversions on international cards and digital wallet payments

- $15 per bounced check

- $4 for failed ACH Direct Debit payments

- $15 for disputed ACH Direct Debit payments

How to calculate Stripe fees

You can use the following formula to calculate any Stripe fee:

(Payment Amount * Percentage Fee) + Fixed Fee

For example, if an in-person customer pays $75 using the Stripe Terminal, you’ll pay ($75 * 0.027) + $0.05. This amounts to $2.075 in Stripe transaction fees.

To calculate what you should ask for, use the formula:

(Desired Amount + Fixed Fee)/(1 - Percentage Fee)

For example, if you want to receive 90 dollars after billing using the digital Payments tool, you should charge ($90 + $0.30)/(1 - 0.029), or $90.30/0.971, which amounts to $93 dollars.

How to reduce Stripe fees

- Use Novo’s Stripe perk: With Novo’s Stripe perk, your first $5,000 in Stripe revenue is fee-free. Sign up to save on transaction fees!

- Combine payments: If you bill customers on a recurring basis, work with them to combine payments to avoid paying fixed fees.

- Use Stripe’s fraud prevention tools: Stripe offers a range of fraud prevention tools, including Radar, that can help reduce chargebacks and disputes.

- Use Novo Boost: Novo Boost allows you to get paid faster at no cost to you. When you receive money from Stripe, your account balance updates instantly.

- Pass the fee on to customers: Pass the fee on to your customers by adding a surcharge to transactions. Verify that this is legal in your jurisdiction before employing this strategy.

- Use fee-free invoicing tools: With Novo, you can send unlimited invoices for free. Novo also integrates with Stripe (in addition to Square and PayPal), so you can accept card payments through your preferred payment processor.

Novo and Stripe

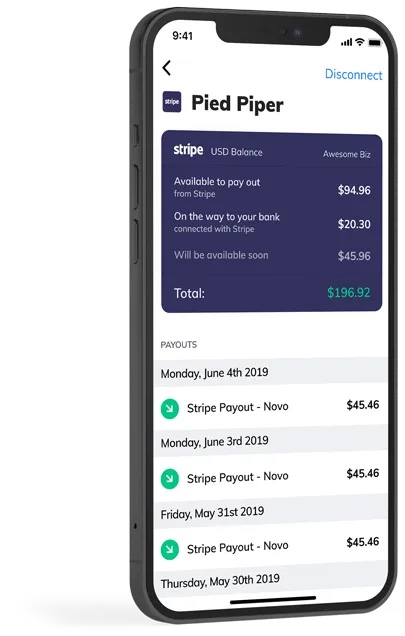

Seamlessly connect Stripe with your Novo account through our Stripe integration. When you connect your Novo account with Stripe, you’ll be able to see your available Stripe balance, funds on the way from Stripe to your Stripe-connected bank account, and funds that will be available for transfer soon. Once you create your Novo account, sign up for our Stripe perk to get $5,000 in fee-free card processing.

Don’t have a Novo account? Apply for one today.

Novo Platform Inc. strives to provide accurate information but cannot guarantee that this content is correct, complete, or up-to-date. This page is for informational purposes only and is not financial or legal advice nor an endorsement of any third-party products or services. All products and services are presented without warranty. Novo Platform Inc. does not provide any financial or legal advice, and you should consult your own financial, legal, or tax advisors.