Free, Unlimited, and Flexible: Reintroducing Novo Invoices

We’re excited to announce several major improvements to make invoicing easier for business owners and the customers they’re billing.

.png)

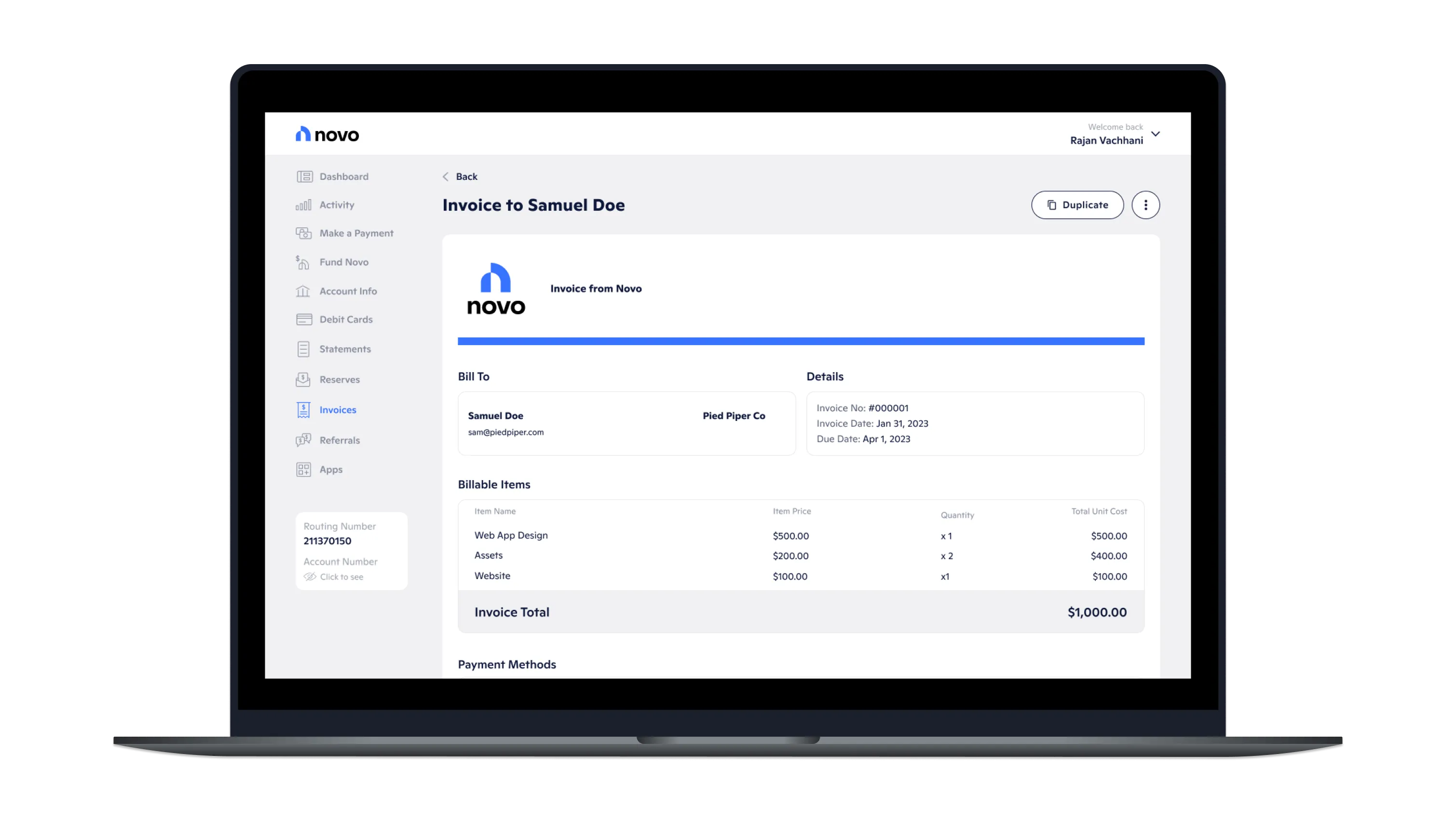

Novo’s free invoicing tool makes it easy for small business owners to send professional, customizable invoices directly from their checking account. Over the past two years, we've helped business owners send more than $350 million worth of invoices. During that time, we started to see new ways we could help simplify the experience for our customers even more and help them get paid faster.

Today, we’re excited to announce several major improvements to make invoicing easier for business owners and the customers they’re billing.

About Novo Invoices

Novo Invoices is available for free, directly in your Novo account, so you can automatically collect and reconcile payments in your transactions dashboard. As with other deposits, paid invoices will be automatically split according to any Reserves percent allocation rules you have set up, such as Profit First.

New: Confrontation-free, automated payment reminders

Let Novo chase down late payments with automated reminders. Novo now sends gentle reminders to your clients regarding outstanding invoices. Save yourself the time, hassle, and potential awkwardness of having to personally follow up on past-due invoices.

New: Your shortcut to invoicing: save line-items library

No more typing out the same items over and over again. With our Line Item Library, you can effortlessly save your frequently used line items, creating a dynamic repository that's always at your fingertips.

New: Added clarity and transparency: attach documents to invoices

Build trust and credibility by offering full visibility into the details that matter most. Now, you can effortlessly attach relevant documents and supporting files directly to your invoices, leaving no room for ambiguity or misunderstanding.

New: Clearer invoices, happier clients: more detailed invoice descriptions

We listened to your feedback about the need for more space to convey the details of your invoice to your clients. That's why we've expanded the word limit to Invoice Descriptions.

Now, effortlessly convey the specifics of your invoices to your clients, leaving no room for time spent on back-and-forth communication.

New: Seamless record-keeping: reconcile invoices

Say goodbye to the hassle of manually matching payments with invoices. Whether you've received payments outside of the standard invoicing process or you're simply looking for a more efficient way to reconcile your financial records, we've got you covered.

Our latest feature allows you to link Invoices to specific transactions in a matter of clicks whether you’re in Novo’s Activity tab or the Invoices hub. Accurate record-keeping now only takes seconds, so you can spend more time growing your business and less time managing it.

Save time running your business: schedule and save draft invoices

You can now save and schedule Novo invoices, saving time and giving you complete control over when you create invoices and when they are sent to your customers. With saved drafts and scheduling, you can plan ahead and generate all your invoices whenever convenient.

You have the flexibility to cancel a scheduled invoice both before and after it's sent out. To minimize confusion, canceling the invoice after the scheduled date will trigger a notification to your customer.

On time, every time: create and automate recurring invoices

When speaking to our customers, the most common feedback we heard was that the ability to set recurring invoices would save business owners hours per month to focus on running their business, as well as ensure that payment requests always went out on time.

With this launch, you can now set up recurring invoices with just a few clicks to automatically send, allowing you to enjoy peace of mind knowing that your invoices will be sent out on time, every time. For better flexibility in managing your payment requests, you have the option to edit or cancel any upcoming invoice.

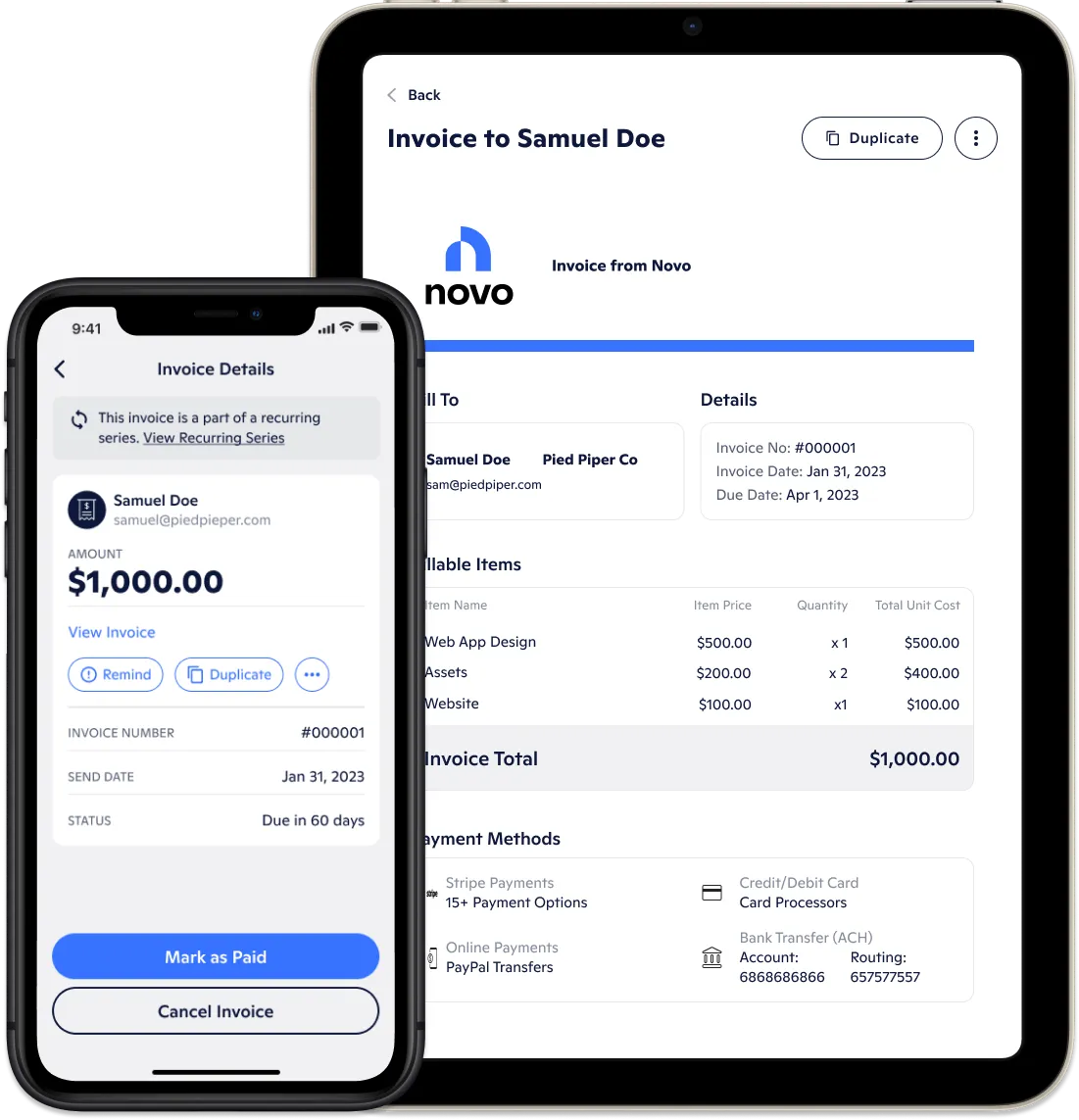

Get paid up to 2.5x faster

Businesses of all sizes struggle to get invoices paid on time. For those with limited cash flow, a delayed invoice payment can bring daily operations to a halt.

The most effective way to get invoices paid quickly is to give customers a variety of payment options. At Novo, we’ve seen that invoices including the option to pay by card are paid early or on time 2.5x more often.

To help our customers get paid faster, we’ve expanded our partnerships with Stripe, Square, and now added PayPal, so you can accept card payments on Novo Invoices through your preferred payment processor. Altogether, these integrations give customers dozens of payment options, including Apple Pay, Google Pay, Venmo, credit card, online ACH, and more.

Give Novo Invoices a try

- Log in to your Novo account and navigate to the Invoices tab

- Go to <Settings>, <Manage Payments> and connect your preferred payment processor whether it be Stripe, Square or PayPal

- Log into your Payment Processor and turn on or off the payment options you want to enable for your customers

Start getting paid faster today with Free, unlimited invoicing that you can customize to your business or schedule.

What’s next

We’re excited to continue improving Novo Invoices throughout 2023, so you can spend less time managing your business and more time growing it.

To learn more about Novo Invoices, check out novo.co/invoices, or experience the feature firsthand by creating an invoice in your Novo account. If you’d like to provide feedback on our latest releases or be involved in future prototypes, please contact us through the Support tab of the Novo app. We’d love to hear from you!