A Webinar with Zendesk on Fintech and the Evolving Customer Experience

Zendesk VP of the Startup Initiatives Kristen Durham hosted Novo Head of Customer Success Brian Kale in a webinar. Read more on their discussion here.

Enhancing the Customer Experience (CX) is more important than ever for small businesses. Previously, companies needed to focus on customer support. But in today’s digital world, CX needs to be evaluated at every touchpoint. Entrepreneurs must have a deep understanding of how to treat and serve their customers through support channels. They must also have the best CX tools for the job to stay ahead of their competitors. We turned to Zendesk, a leading customer service and engagement platform, to discuss the importance customer experience plays in the fintech industry. In their latest webinar, Zendesk VP of the Startup Initiatives Kristen Durham and Novo Head of Customer Success (CS) Brian Kale, went in depth on how having a customer-centric approach is helping challenger banks disrupt a traditional industry. Read on to learn the main takeaways and how you can improve your customer success strategy. Learn More About the Webinar Here

We also have an upcoming meetup discussion with Zendesk on December 12 to discuss how you can build a customer focus team while staying cost effective.

Build a Customer Experience Early on

When you’re starting your business, one of the main questions to ask is, “who are your customers?” As an entrepreneur, you need to know who is interested in buying your product and why they’re interested. Once you figure this element out, you can begin thinking about ways you can help them have a more enjoyable and less stressful customer experience. Kristen started the webinar by sharing some wisdom on the importance of building a positive customer experience from the get-go. “Customers are the first thing that really start making your company real,” Kristen states. “You haven’t had a chance to build a reputation yet, and the customers [expectations of how you will respond to them] are very important.”

One of the most reliable indicators of business success is brand loyalty, and creating a strong bond from the very beginning with customers helps to retain them. You ultimately nurture this bond and establish trust by answering their concerns. It's also important to consider their needs and offer them support throughout their customer journey. Customers' feedback must also be taken into account in the product roadmap. Perhaps there are common issues that customers are facing, and it's your job to do something about it. Kristen notes that the three main ingredients of a strong CX strategy are "responsiveness, empowerment, and transparency." Once you have these ideas in mind, you can begin developing the best possible customer success team and plan.

The Current State of Small Business Banking

The financial services space has been a crowded market historically. Kristen cites research that 90% of those in the financial services space believe that customer focus is embedded across their business. However, the same survey finds that 40% of them are not satisfied with current CX practices. "Where there has been an opportunity for differentiation and for disrupting the status quo; convenience, personalization, and financial inclusion have been three of the really important dynamics that have driven the opportunities that companies like Novo are jumping on top of," Kristen says.

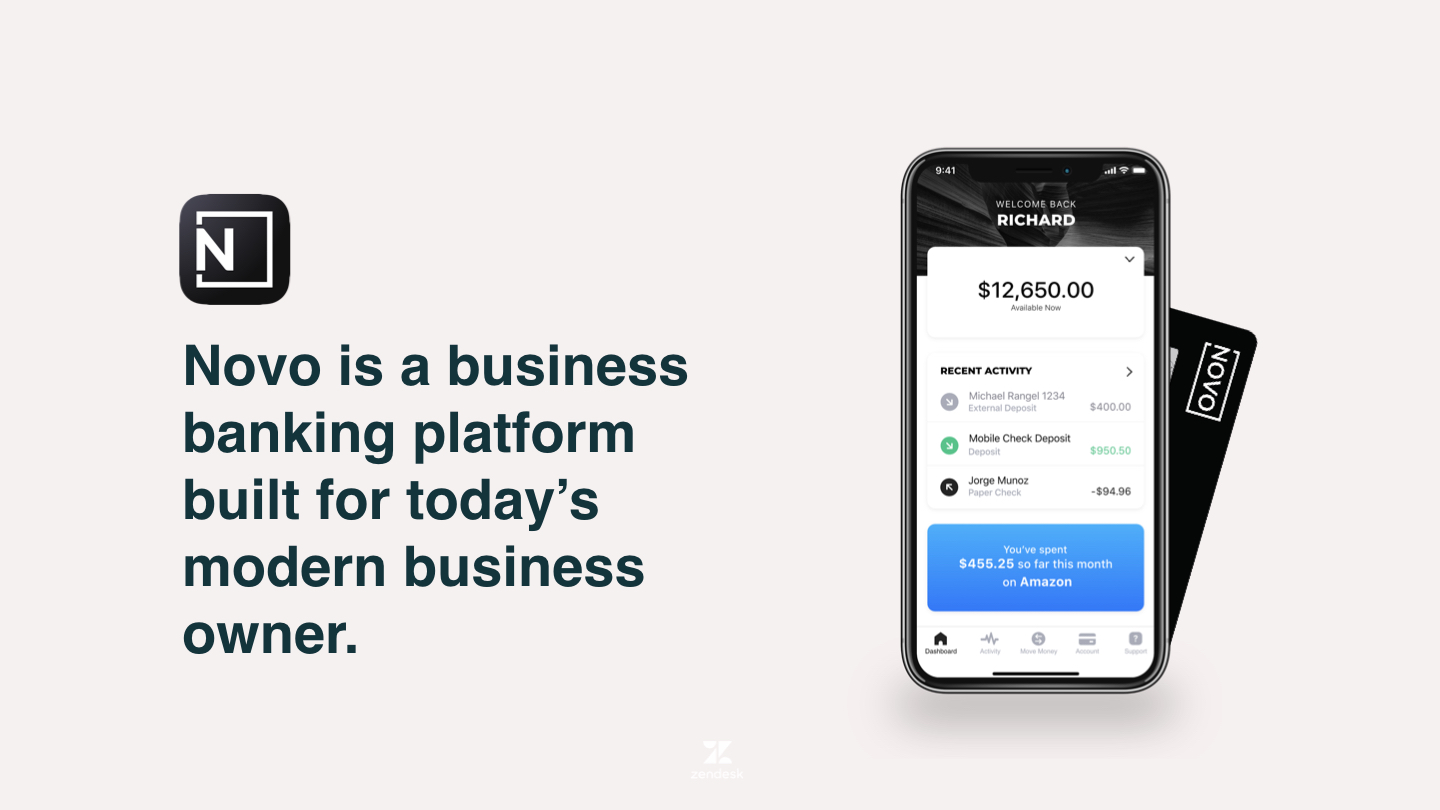

At Novo, we are seeking to transform the way the financial services industry operates. Brian shares that we are born out of a changing economy and marketplace. He talks of the gig economy that young entrepreneurs are so fond of, but has no official playbook. Big banks have been unable to keep up with the gig economy, and Novo seeks out to address the needs of these entrepreneurs. Brian added:

Small banks used to be the backbone of the American economy. They used to be where small businesses would get loans, put their money--how’d they start their businesses.

And Novo is bringing small businesses back to the limelight with a digital business banking platform that provides a seamless online experience.

The Transformative Novo Customer Experience

Our app charges no hidden fees, and we focus on optimizing the customer experience. Just ask Novo customer Mark Tsigounis, founder of Hibear. He went on Kickstarter to create a multi-purpose, utility water bottle that is launching to the public later this year. “Novo was built specifically for us,” Mark said. “They get startups.” Lodged Out Founder Bobbilee Hartman is another Novo customer who has embraced the gig economy, and started her own business. She is also a full-time developer for Square, but her passion for the outdoors led to her other project. “Lodged Out was her side hobby,” Brian says. “She wanted to organize retreats to disconnect from technology and have experiences in groups. It became so profitable that she started her own business.”

These successful startup founders chose Novo because of our product, as well as our customer experience. And developing this CX has been a labor of love by Brian and the CS team. “Novo is trying to be on the cutting edge [by helping] these founders find the tools they need to get in business and stay in business longer,” Brian says. These founders sometimes don’t get the support they need, and we aim to change that with our CX strategy, he adds.

Early Novo Pain Points and Changes

When we first implemented the Novo customer success strategy, we had tools we weren’t ready for yet. Brian talks about adding live chat for customers, which didn’t work because we only had him and another agent handling all requests. This feature would cause issues with customers if we didn’t respond to them quickly as they would think live chat was the only way to connect with our staff. As a result, some customers would get impatient and share their frustrations on social media. Since then, we’ve made some changes. “Novo built several custom tools to elevate our team and user experience.” One such tool is a new mobile widget that operates in a similar way to emails, but more sophisticated. Customers can lodge their complaints, and the widget will pick up on any significant keywords. Based on these keywords, the widget then sends users and non-users to relevant articles. The tool has improved the user experience for many, increasing the number of searches and article views we get a month to 3,000 and 8,000 respectively. In the case the user still needs help after being sent to the FAQ page, we’ll connect them to a CS agent. “If I have a problem, I want a human,” Kristen says, paraphrasing Brian. “If I have a question, I want an answer.”

Key Initiatives that Novo Is Working on

Our CS team now includes Brian and four more agents, and we will likely hire two or more agents before the year is over. In addition to having more employees on our staff, Novo is adding agent support shadowing. This concept consists of having every Novo employee sit with a customer success representative. During these shadowing sessions, both employees will talk to customers and answer tickets together. Better understanding our users, their frustrations, and common questions allows us to improve our product. This connection creates a continuous feedback loop between our employees, CS team, and customer. Brian adds that we are also developing a new type of CS worker known as the onboarding agent. This person can call or live chat with applicants during the application process. They will be a specialized agent who is there every step of the application process, answering questions, helping with documentation issues, and more.

"It's all about taking customer service, and turning it into customer support, which then ultimately becomes customer success," Brian says. We want to support our users before they become customers--before they pay anything. It may take many months and touchpoints to get them fully onboarded, but we do it because we care about giving our users the best CX.

Other Ways Novo Helps Businesses

The webinar ended with a few questions from the public, including the following. "Where does Novo see its greatest contributions in preventing companies from closing in their first year?" Brian answers by noting that education is critical. We offer value with features, tools, and integrations with other top financial software. Besides, we explain vital elements of the gig economy, such as the benefits of a business banking account. Plus, we share helpful reading material for freelancers, and information on the legalities of starting a business. "Novo is ramping up and building out this content machine to provide as much education [as possible]," Brian adds. Things that "we've learned or that our users have told us they've learned, to create a community of founders for founders," he finishes.

Our goal is to create the best possible customer experience from multiple angles, ensuring our users are happy they chose Novo.

The Takeaway

There are many ways to approach creating a customer experience, and no one can tell you exactly how to do it. It’s a matter of learning your customers, what their needs are, and any concerns you may have. What we can say is that there are some best practices that you can implement to develop the best CX strategy as possible. And as Kristen mentioned, it boils down to responding quickly, empowering your customers, and being transparent.

Zendesk for Startups Program offers qualifying startups Zendesk credits for an entire year to use on Zendesk Suite (Support, Chat, Guide, and Talk products). The program also provides highly curated resources and exclusive invitations to community and partner events.