Square Fee Calculator

To determine how much you’ll pay in Square fees and receive after fees are deducted, enter the transaction amount into our Square fee calculator.

Understanding Square Fees

Square is a widely-used payment processing tool that allows businesses to sell products and services in person and online.

There are four ways to collect customer payments via Square:

- Online: Set up a website with Square Online, the company’s e-commerce platform, or connect Square’s payment functionality with your existing website to enable payments via Square at checkout.

- In-person: Use Square’s point-of-sale (POS) system to accept in-person card payments.

- Manually: Manually enter customer card details into the Square app to accept payments.

- Via invoice: Send invoices digitally to request payment for products or services.

Like most payment processing companies, Square charges transaction fees. To determine how much you’ll pay in Square fees and how much you’ll receive after fees are deducted, enter the transaction amount into our Square fee calculator above. Our calculator will determine Square fees for in-person payments, manually-entered payments, and online payments, each of which uses a different fee structure.

Keep reading to learn about other types of Square fees.

How much does Square charge?

For payments accepted through Square, the company deducts the following processing fees:

*Information accurate as of March 1, 2023

Note that for invoices paid by ACH bank transfer, Square charges a 1% transaction fee with a minimum of $1 per transaction.

How to calculate Square fees

You can use the following formula to calculate any Square fee:

(Payment Amount * Percentage Fee) + Fixed Fee

For example, if an in-person customer pays $50 using the Square Terminal, you’ll pay ($50 * 0.026) + $0.10. This amounts to $1.40 in Square transaction fees.

Other Square fees and costs

In addition to processing fees, Square charges for its commerce tools and plans:

Hardware costs

While Square’s basic magstripe-only card reader is free, other, more advanced systems cost money. Here is a breakdown of hardware costs for Square’s POS products:

- $10 for each additional Square Reader for magstripe-only payments

- $49 for Square Reader for contactless and chip payments

- $149 for Square Stand, an iPad POS

- $149 for Square Stand Mount

- $299 for Square Terminal, a credit card machine with a built-in printer

- $799 for Square Register, a fully-integrated POS register for managing payments, online sales, pickup, and delivery

Subscription fees

Square offers a free plan (just pay transaction fees), but charges for their Plus and Premium plans.

- Plus plan: $29/month (billed annually), plus 2.9% + $0.30 per transaction

- Premium plan: $79/month (billed annually), plus 2.6% + $0.30 per transaction.

How to reduce Square fees

- Avoid manual payments: Square charges a higher fee for manually keyed-in transactions due to the increased risk associated with these transactions. If possible, encourage customers to pay in person or online.

- Apply a surcharge on credit card transactions: Pass the fee on to your customers by adding a surcharge to credit card transactions. Make sure this is legal in your jurisdiction and compliant with payment network rules before doing this.

- Use fee-free invoicing tools: If your business primarily invoices customers, consider using Novo’s invoicing tool, which is free to use. Novo also integrates with Square (in addition to Stripe and PayPal), so you can accept card payments through your preferred payment processor.

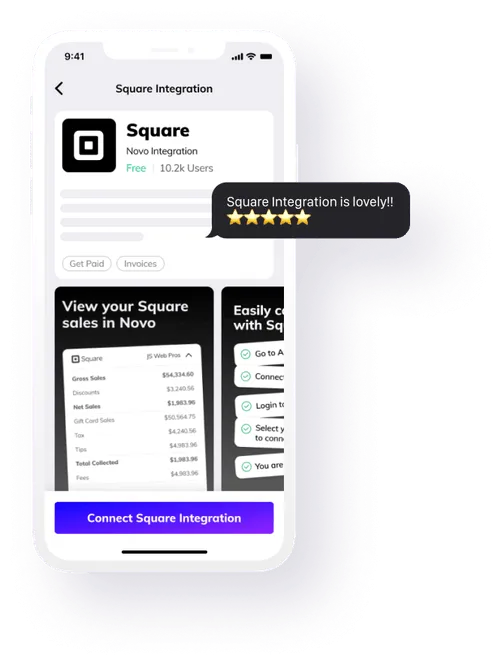

Novo and Square

Seamlessly connect Square with your Novo account through our Square integration. By signing up for a Novo account and integrating with Square, you’ll gain:

- Access to our robust suite of business banking tools

- Increased visibility into your Square sales data, taxes, funds, and more

- Ability to integrate with other tools you love, including Stripe, Shopify, eBay, Amazon, and Etsy

- Access to as much as $3,000 in savings with our Perks program

Don’t have a Novo account? Apply for one today.

Novo is a fintech, not a bank. Banking services provided by Middlesex Federal Savings, F.A.: Member FDIC.

Novo Platform Inc. strives to provide accurate information but cannot guarantee that this content is correct, complete, or up-to-date. This page is for informational purposes only and is not financial or legal advice nor an endorsement of any third-party products or services. All products and services are presented without warranty. Novo Platform Inc. does not provide any financial or legal advice, and you should consult your own financial, legal, or tax advisors.